512.904.9900

Public Adjusters

Claim Assistance Available 24/7

"Leaky Roof? Get It Fixed Fast – Book a Free Inspection Today!"

"Don't let small leaks turn into big problems. Schedule your no-obligation inspection and protect your home from costly damage."

Are you tired of hearing that [Common Belief] is the only way to achieve [Desired Result]? What if we told you there’s a faster, simpler way to get the results you want, without the stress and hassle of [Common Belief]?

Licensed & Insured Roofing Experts

Lifetime Warranty on Materials

Fast, Free, No-Obligation Inspections

Certified Roofing Company

When the Storm Hits, Experience Matters

We help Commercial, Multifamily, Industrial & Religious Properties get the settlement you deserve!

We represent policyholders only—not insurers—on complex multifamily and commercial claims. We’re built for scale: multi-building campuses, stacked policies, multiple deductibles, lender requirements, code upgrades, and time-element losses.

INSURANCE COMPANIES HAVE EXPERTS WORKING FOR THEM. YOU SHOULD, TOO!™

We help Commercial, Multifamily, Industrial & Religious Properties get the settlement you deserve!

When the Storm Hits, Experience Matters

Fast, Free, No-Obligation Inspections. We’ll Be in Touch Within 24 Hours!

We represent policyholders only—not insurers—on complex multifamily and commercial claims. We’re built for scale: multi-building campuses, stacked policies, multiple deductibles, lender requirements, code upgrades, and time-element losses.

20+

Years Of Experience

500+

Large-Loss Claims Settled

130,160

Hours Worked

$450,000

Average Claim Amount

Who we serve (multifamily & commercial asset classes):

Apartment communities

Condominiums

Townhomes

Homeowner Associations (HOAs)

Build-to-rent

Senior living

Student housing

Religious organizations (churches, synagogues, mosques)

Hotels & hospitality

Schools & universities

Industrial parks & warehouses

Self-storage facilities

Hospitals & healthcare

Retail buildings & shopping centers

Office buildings

Mixed-use

Government & civic buildings

Historic properties

Specialty structures

Perils we handle:

Hurricane

Tornado

Hail

Wind

Freeze

Flood

Collapse

Fire/Smoke

Water Damage

Business Interruption (including extra expense, civil authority, ingress/egress, contingent BI, and service interruption)

Apartment & Multifamily Storm Damage Claims

Commercial Building

Storm Damage Claims

Luxury Home

Storm Damage Claims

Storm Claim Results For Policyholders

ICRS Advocates For Policyholders

No Recovery, No Fee Representation*

We don’t get paid unless you do.

Proven Results

Successfully settled hundreds of millions in property damage claims.

Expert Representation

500+ large-loss claims settled fairly & promptly.

Avoid Unnecessary Litigation

We maximize settlements without unnecessary legal battles.

Licensed Public Adjusters Nationwide

We work exclusively for policyholders, not insurers.

Verifiable Success

Increased settlements over initial offers by 20% to 3,830%+

Policyholder Rights

Insurance in the U.S. is largely state-regulated, but there’s a shared baseline:

Good-faith, fair claim handling: Most states follow versions of the NAIC’s Unfair Claims Settlement Practices Act, requiring reasonable standards for prompt investigation, fair settlement when liability is reasonably clear, and no denial without a reasonable investigation. (NAIC)

Equal consideration / fair dealing: Courts describe the insurer’s duty of good faith as giving “equal consideration” to the insured’s interests—not just the insurer’s own. (Justia Law)

“Indemnity”: Being Made Whole (No More, No Less)

Property insurance is designed to indemnify—i.e., make you whole after a covered loss, not profit from it. Practically, that means ACV vs. RCV, depreciation/holdback rules, insurable interest, and sub-limits that cap categories like code upgrades or debris removal. (Insuranceopedia, US Legal Forms)

Where State Law Can Be “Tough on Bad Faith” (Examples)

Policyholder remedies vary by state. A few illustrative examples:

Florida: A statutory first-party bad-faith remedy (Fla. Stat. §624.155) allows civil actions for not attempting in good faith to settle when the insurer should have done so, subject to CRN prerequisites. (Florida Legislature, Justia Law)

Texas: The Prompt Payment of Claims Act (Ch. 542) imposes strict timelines and allows statutory interest and attorney’s fees for delayed payment; Ch. 541 prohibits unfair settlement practices (e.g., failing to attempt prompt, fair, equitable settlement; refusing to pay without a reasonable investigation). (Texas Statutes, Findlaw, texaswatch.org)

California: Courts recognize a first-party bad-faith tort; jury instructions address failure to properly investigate. (Justia)

Washington: Policyholders may leverage the Consumer Protection Act for unfair claims handling in some situations, with damages and attorney’s fees.

Note: Remedies are jurisdiction-specific and frequently updated. We help you navigate your state’s rules and coordinate counsel where appropriate.

Why a Multifamily/Commercial Specialist?

Multifamily and commercial claims aren’t “big home claims.” They’re different:

Multiple locations & schedules: Per-building vs. blanket limits, margin clauses, occurrence vs. location deductibles, wind/named storm deductibles.

Occupancy & habitability: Unit turn, rent loss tracking, relocation, lease compliance, lender notifications.

Code & compliance: Ordinance or Law (A/B/C), ADA/IBC triggers, roof assemblies, mechanical/electrical/plumbing, historic-district constraints.

Proof & pricing: Moisture mapping, test cuts/cores, uplift testing, ITEL, lab analysis, engineering causation, Xactimate estimates, large-loss scopes, contractor reconciliation.

Time-element: BI worksheets, period of restoration, lead times, supply-chain, and critical-path scheduling.

Multifamily and commercial claims aren’t “big home claims.” They’re different:

The StormDamageAdjusters.com Large-Loss Process

1. Triage & Coverage Map

Rapid policy review (forms, endorsements, sub-limits), deductibles & waiting periods, potential anti-concurrent causation issues.

2. Forensic Documentation

Drone & mast imaging, thermal/moisture mapping, engineering & architectural opinions, roof cores/uplift testing, lab and ITEL, code & manufacturer standards.

3. Scope & Valuation

Building-by-building estimates, contents/inventory, code upgrades, soft costs, BI/extra expense modeling (rent roll, ADR/RevPAR, tenant reimbursements, payroll, mitigation).

4. Carrier Coordination

Set inspection protocols, evidence exchange, meeting of the minds on scope and pricing, and appraisal/alternate dispute resolution when appropriate.

5. Settlement & Closeout

Recoverable depreciation, supplements, lender draw support, contractor reconciliation, sworn POL compliance, and documentation for asset management and auditors.

What Policyholders Need to Watch (Ins & Outs)

Deadlines: Notice, Proof of Loss, suit limitations, CRN (where applicable), and mortgagee notifications.

Sublimits & Traps: Code upgrades, cosmetic damage endorsements, protective safeguards warranties, distance-to-coast wind deductibles, roof surfacing limitations.

BI Reality: Lead times, critical path, supply chain, code delays—period of restoration isn’t just the construction calendar.

Fair Investigation: Insurers must reasonably investigate—cherry-picking or ignoring favorable evidence can violate unfair claims standards. (NAIC)

How We Work (Clear & Simple)

ICRS Public Adjusting (Contingency): For losses > $250,000 after deductible, we work on no recovery, no fee.

ClaimNavigator (Flat-Fee Consult): For claims under $250,000, get guided support for a $250 flat fee.

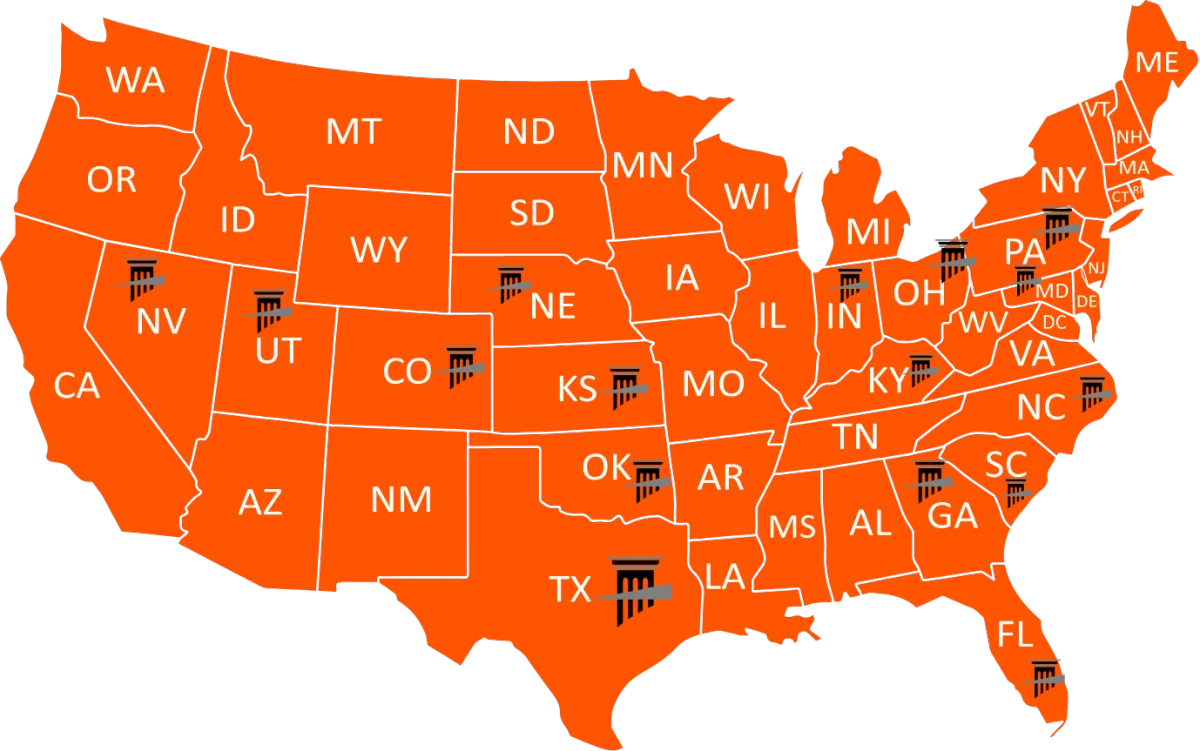

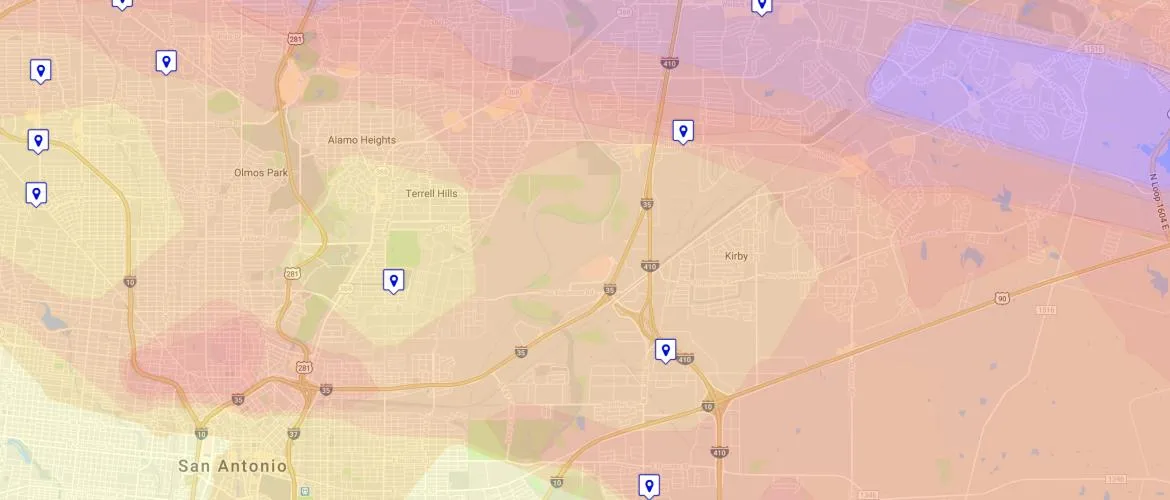

Service Area (Licensed States): TX, CO, FL, GA, IN, KS, KY, MD, NE, NV, NC, OH, OK, PA, SC, UT. Services offered where state licensure permits. (We are not licensed in CA, NM, IL, AR, MO, LA, MS, AL, MN, WI, MI.)

Not legal advice. For litigation strategy or statutory deadlines, we coordinate with counsel.

Educational Resource:

Insurance Claim Bible

Struggling With?

Initial Storm Claims

Whether you're filing an insurance claim for a commercial building, an apartment complex, or a luxury home, filing it correctly from the outset is crucial.

Large-loss hail claims involve significant property damage and high-dollar settlements. As one of the Nation's most trusted public adjusters, we make sure your initial claim is accurately documented, aggressively represented, and positioned for maximum settlement in minimum time.

Underpaid Storm Claims

Insurance companies often lowball hail claim payouts especially on large-loss properties. If your settlement doesn’t match the real scope of damage, you could be leaving thousands on the table.

At ICRS our experts identify missed damage, undervalued estimates, and hidden policy coverage gaps. We reopen, negotiate, and supplement

underpaid claims to recover what you’re truly owed.

Delayed or Denied Storm Claims

Denied hail claim in Austin? You’re not alone. Insurers often cite

policy exclusions, pre-existing damage, or missing documentation

to avoid paying.

Our Austin-based public adjusters specialize in

overturning wrongfully denied hail claims - correcting inspection errors, providing new documentation, and demanding fair treatment.

Get Help Now

Complimentary Large-Loss Claim Review

Upload your policy and photos, and we’ll map coverage, scope, and time-element exposure.

Under $250K?

Use ClaimNavigator for a guided consult at $250 flat.

Let’s protect NOI, preserve asset value, and speed recovery.

Start at StormDamageAdjusters.com

Compliance & Consumer Resources (Selected)

NAIC Unfair Claims Settlement Practices Act (model). (NAIC)

United Policyholders 50-State Bad Faith Survey (2025).

Florida §624.155 Civil Remedy. (Florida Legislature)

Texas Ch. 542 Prompt Payment; Ch. 541 Unfair Settlement Practices. (Texas Statutes, Findlaw)

35 + Successful Projects

Local Roofing Experts

100% Guarantee

Licensed Public Adjusters In 16 States:

Get Help Now

Complimentary Large-Loss Claim Review

Upload your policy and photos, and we’ll map coverage, scope, and time-element exposure.

Under $250K?

Use ClaimNavigator for a guided consult at $250 flat.

Let’s protect NOI, preserve asset value, and speed recovery.

Storm and wind damage

Start at StormDamageAdjusters.com

Compliance & Consumer Resources (Selected)

NAIC Unfair Claims Settlement Practices Act (model). (NAIC)

United Policyholders 50-State Bad Faith Survey (2025).

Florida §624.155 Civil Remedy. (Florida Legislature)

Texas Ch. 542 Prompt Payment; Ch. 541 Unfair Settlement Practices. (Texas Statutes, Findlaw)

Storm Specialists

Trusted Storm Claim Experts—HAAG-Certified & Ready to Help

Navigating a large hail damage claim? Our HAAG-certified adjusters specialize in identifying storm-related losses insurers often overlook. We ensure business owners get the full value of their policies—no excuses, no delays.

35 + Successful Projects

Local Roofing Experts

100% Guarantee

Build Roof Standard

Licensed & Insured

Providing Quality

Leaks and water damage

Why Choose ICRS TESTIMONIALS

Hear what Our Clients are saying

"Thank you Scott"

Scott responded to my inquiry and took the time to listen and understand our unpleasant experience dealing with our insurance claim. Although I did not utilized his service, he gave me a sound, professional advice and offered to help when he referred me to his engineer. They replied promptly and I was able to have better understanding of the situation. Thank you Scott!

- Haidee J.

"I would highly reccomend"

Words can’t describe how grateful we are for the consultation and claim evaluation we had with Scott. Full disclosure we were unable to work with him due to limitations of our scope. We wanted to properly recognize Scott for the honest and genuine passion he put in to not only our claim, but the way he runs his business in general. We hadn’t had such clarity of next steps since this began in 2020. I would highly recommend this business to everyone spinning their wheels in this process!

- James M.

"I came across this company and had none of those bad feelings"

This was not the first public adjuster I called. I called a different company first but they gave me a bad feeling on the phone. Too aggressive. Didn't feel trustworthy to me. So, I kept looking. I came across this company and I had none of those bad feelings. Scott, the guy who took my call, seemed very knowledgeable and I felt I could fully trust him. As it turned out, he told me that my claim was fairly simple and I didn't need the full scope of his service and fees. But, without charging me a fee, he gave me some needed advice on this whole matter of insurance claims which I needed. And told me I could call him back to ask another question or two if necessary. I would recommend this company for these services.

- Katie H.

You’re serious about [Desired Result] and want a quick, easy-to-follow guide to get there.

You’re struggling with [Common Pain Point] and need a clear path to [Desired Outcome].

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’re serious about [Desired Result] and want a quick, easy-to-follow guide to get there.

You’re struggling with [Common Pain Point] and need a clear path to [Desired Outcome].

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

ATTENTION: TARGET AUDIENCE

How To Desire Without Doing Z To Achieve Goal

Download the free report and take your marketing to the next level

Unsure If you need a public adjuster?

Frequently Asked Questions

What if my carrier denies my claim without examining key evidence?

States adopting NAIC-style rules prohibit refusing to pay a claim without a reasonable investigation and require good-faith efforts to settle when liability is clear. (NAIC)

Do insurers have to weigh my evidence fairly?

Courts describe the insurer’s duty of good faith as giving equal consideration to the insured’s interests—a principle that underpins fair investigation and settlement. (Justia Law)

What does “indemnity” really mean for my payout?

You should be made whole (subject to coverage). ACV vs. RCV determines depreciation/holdback; endorsements and sub-limits can cap categories like code upgrades. (Insuranceopedia)

Is my state “tough” on bad faith?

It depends. Florida provides a statutory first-party remedy; Texas enforces prompt-payment with statutory interest and fees; California recognizes first-party bad-faith and requires proper investigations; Washington allows CPA claims in certain circumstances. We tailor strategy to your jurisdiction. (Florida Legislature, Texas Statutes, Justia)

Innovation

Fresh, creative solutions.

Integrity

Honesty and transparency.

Excellence

Top-notch services.

AGENCY PUBLIC ADJUSTER LICENSES

MISTY'S PUBLIC

ADJUSTER LICENSES

SCOTT'S PUBLIC ADJUSTER LICENSES

Our Large Loss Specialties

Contact Us

LEGAL

Copyright 2026. ICRS LLC. All Rights Reserved.